BlackRock’s 50/30/20 Portfolio Strategy: How Maclear AG Simplifies Access to Alternative Investments

When BlackRock CEO Larry Fink speaks, markets listen. His latest proclamation? The financial roadmap followed by three generations of investors – the traditional 60/40 portfolio – is officially outdated.

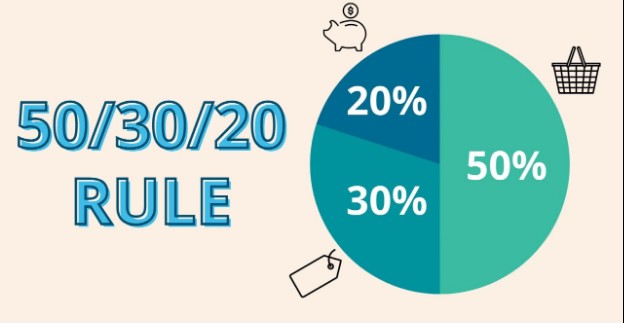

According to Fink, who manages the world’s largest assets, a better investment model of 50/30/20 is more suitable for this increasingly complex financial landscape.

This model allocates 50% for equities, 30% for bonds, and 20% for other investment alternatives, including real estate and private equity investment portfolios. While this is a major shift from traditional financial standards, for the regular investor, institutional markets have been leaning towards alternative markets for some time now.

When tradition failed: the fall of the 60/40 portfolio

The 60/40 portfolio strategy served investors well for its time. But how did this era come to an end? Let’s take a closer look at the history of the 60/40 portfolio.

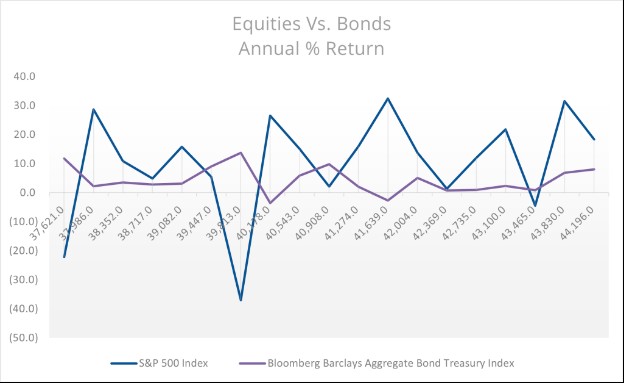

Introduced following World War II, the 60/40 investment portfolio model diversified investment into 60% stocks (for growth) and 40% bonds (for stability). Nevertheless, it had to undergo numerous cycles of change and refinement on its way to its peak. Sadly, its drawbacks proved too great to ignore with the simultaneous fall of both bonds and stocks in 2022.

Why BlackRock Abandoned the 60/40 Model

Much of investment thrives on the back of historical data and the information investors as well as financial decision makers have available to them. For BlackRock, the year 2022 was an eye-opener, exposing the 60/40 portfolio as bound to become a relic of the past, notably susceptible to:

- Inflation vulnerability: In 2022, central banks consistently hiked interest rates due to ongoing inflation. This posed a struggle for investors as bonds could not hedge against inflation, and consumer prices soared at an average of 6.5% over 2022–2023.

- Simultaneous declines: the double-edged sword of this inflation saw unprecedented drops in value for stocks and bonds alike. For instance, traditional investors with their 60/40 portfolio watched helplessly as the S&P 500 plummeted 19%, while bonds lost 13%. This further deteriorated trust in traditional diversification.

- Fink’s perspective: In the wake of these happenings, he concluded that the 60/40 model has outlived its diversification objective. With AI-driven growth and private infrastructure rapidly taking over, asset managers would require a fresh approach.

The new blueprint: BlackRock's 50/30/20 strategy

As a retail investor, understanding what most successful institutional investors have known for a while now will give you a kind of leverage most ordinary investors don’t have, the 50/30/20 budgeting strategy being a prime example.

Let’s break it down.

Breaking Down the Modern Portfolio Structure

Today’s investment landscape requires a more nuanced investment strategy, as reflected in BlackRock’s 50/30/20 portfolio structure. The three asset categories which correlate to this allocation include:

- 50% to equities: This category of assets also includes stocks in transformational industries like AI, advanced manufacturing, clean energy, and other areas exhibiting structural growth advantages.

- 30% to bonds: This next-largest share goes to assets that ensure securities against inflation, including Treasury Inflation-Protected Securities (TIPS) with other conventional elements for better inflation resistance.

- 20% to alternatives: What’s left over is directed to private equities, real estate, infrastructure projects, and other unconventional assets that do not rely on the public market to deliver returns on investments.

Why Alternatives Matter More Than Ever

The game-changing pivot toward alternatives in BlackRock’s strategy is not by chance. On the contrary, it follows the same approach that top institutional asset managers like David Swensen have employed for many years.

Case in point – David allocated a minimum of 40% (not 20%) yearly to alternative investments for Yale University’s Endowment. This has yielded 11.3% annualized returns for 20 years as of 2022, irrespective of economic downturns.

The benefits of these alternative allocations include:

- Inflation-resistant cash flows: You can generate consistent income from sectors like clean energy, infrastructure development, and data centers irrespective of a dip in stock market prices.

- Exposure to private innovations, which are considered high-growth sectors and are not accessible to players in the public market but only through other mechanisms like venture capital.

- Lower correlation with traditional markets, which gives a level of protection from the downturns of public markets.

The Alternative Investment Dilemma: Why Retail Investors Struggle

Despite the numerous benefits it yields, alternative investments have consistently remained out of reach for retail investors. Essentially, there are several barriers often enforced by traditional private markets bringing about exclusivity for institutional investors.

The Liquidity and Accessibility Barriers

For traditional markets with private assets like real estate, liquidity barriers come in the form of fund requirements, including:

- Prohibitive minimum investments: A typical minimum participatory fund often ranges between $50,000 and $250,000, automatically excluding individual investors.

- Extended lockup periods: Standard fund lockup periods often extend to 7-10 years with no flexible options for an exit.

- Complex documentations: So many details, pages with fine print, and terminologies to consider when finalizing subscription agreement making the documentation process too cumbersome.

- Accreditation requirements: Eligibility to participate in some investments requires some strict income or net worth threshold, further raising the barrier of entry even higher.

Fee structures and transparency issues

Another barrier for retail investors involves transparency with fees and structures, which often comes after they’ve managed to scale the hurdle of the liquidity barrier.

Consider that the traditional standard fee structure, which demands a 2% management fee and an additional 20% performance fee, significantly drains returns on investment for alternative investments. Compare these to 0.03% and 0.10% annual fees for ETF investments, saving more of the investor’s capital.

How Maclear AG Democratizes the 50/30/20 Strategy

We are all well familiar with the widespread strict collateral requirements, high rejection rates for small businesses, lack of transparency, high borrowing thresholds, steep interest rates, and hidden fees.

The barriers hindering individual investors from participating in alternative portfolios present nothing but opportunities. Thankfully, a peer-to-peer business lending platform like Maclear AG is dismantling the structural barriers that have kept those investors from accessing the same portfolio strategies as Yale’s legendary endowment.

Rethinking Access to Alternative Investments

Starting with the access barrier, Maclear AG has developed an approach that allows retail investors access to alternative investments. Maclear did not just drop the entry threshold. It’s supercharged operations with a number of shrewd mechanisms:

- Unlike the traditional investment portfolio that charges 2% management and 20% performance fee. Maclear AG does not charge investor any fee, except from their financial service providers when depositing or withdrawing from Maclear’s platform.

- Bonuses like 2% for referrals, 2% cashback, and a 2% loyalty perk.

- An intuitive investment tracking dashboard that allows investors to monitor their transactions and earnings transparently and with ease.

- A profit calculator to help determine what a user’s profit is going to be from making an investment in a particular project.

- Customized statements providing full transaction details.

Addressing Liquidity Concerns

To solve the liquidity barrier, Maclear AG has employed a forward-thinking technological approach that has generated $17,875,854 for an average return of 14.9%. Proper diversification through various pre-vetted investment pools has allowed 4,251 investors to decide on which combination of projects to invest in.

Final thoughts

Larry Fink’s affirmation of the 50/30/20 allocation investment model is not a new trend to start a lengthy analysis to determine whether it truly works. Frankly, a plethora of institutional investors have applied it with dramatic success over the course of many decades.

The only difference here is that platforms like Maclear AG have brought it within the reach off retail investors with the opportunity to enjoy the same benefits big-time investors have enjoyed for so long.

So, if you are an individual investor looking to expand beyond the now obsolete 60/40 investment allocations, Maclear AG offers you practical implementation tools along with educational resources. The 60/40 has served the past generation of investors. However, the 50/30/20 budget is here to serve the new investment generation, and with Maclear AG, even individual investors have nothing holding them back.