New Borrower Scoring System

Being a registered member of PolyReg SRO, Maclear is committed to maintaining the highest safety standards for both investors and borrowing projects. We strictly adhere to Swiss regulatory criteria, including AML, KYC, and GDPR guidelines, as well as constantly work on improving the assessment process.

Our safety team regularly reviews the industry standards and do their best to ensure the Maclear platform 100% corresponds to them.

To further enhance transparency and decision-making, we’re introducing an updated scoring system. From this moment on, we’ll use it for assessing and rating the financial health, risk profile, and overall performance of a company, before adding it to the Maclear platform.

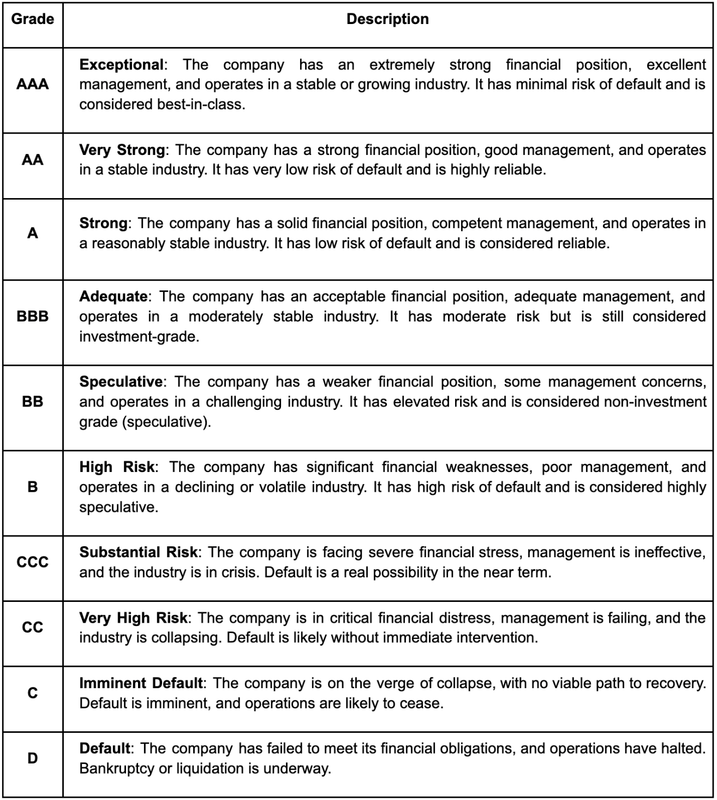

AAA to D Investment Grade Credit Rating

The scoring model chosen by Maclear experts employs a grading scale from AAA (exceptional) to D (default), consistent with industry standards used by leading credit rating agencies such as S&P Global, Moody’s, and Fitch Ratings.

It looks like this:

Each grade corresponds to a specific Probability of Default (PD) in terms of a country of each business origin, which quantifies the likelihood of the organization failing to meet its financial obligations. This approach ensures a clear, transparent, and actionable assessment of risk.

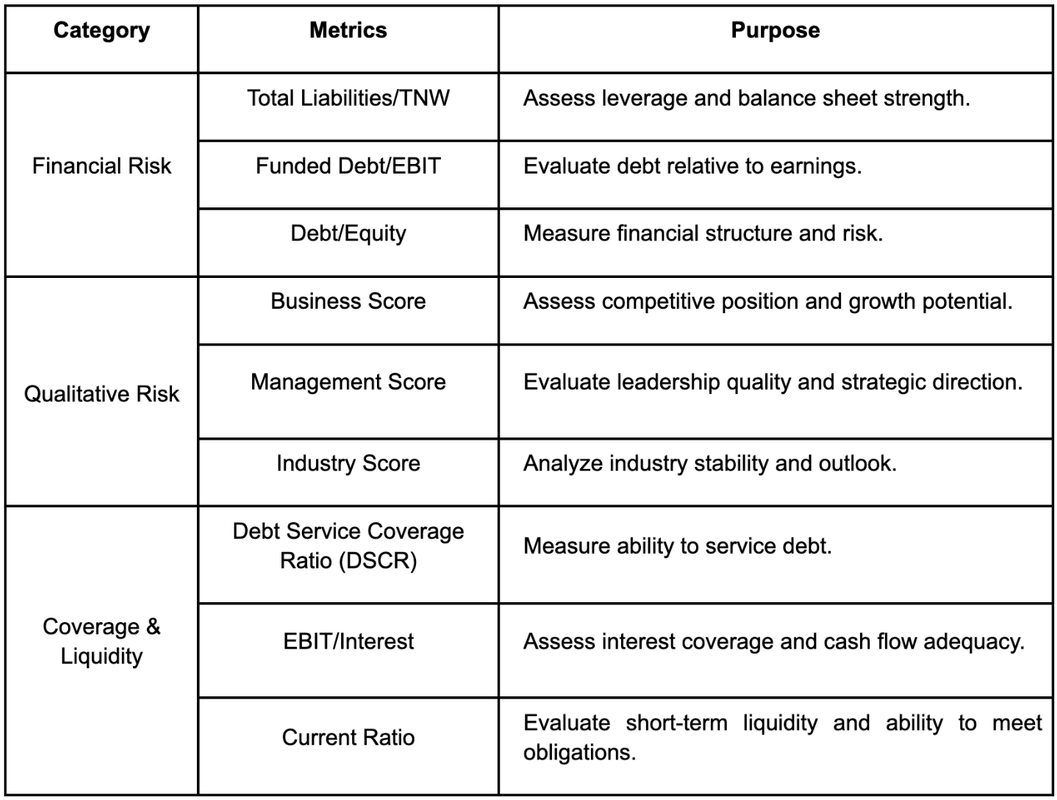

Scoring Model Components

While the main objective of the model is to ensure a comprehensive evaluation of key risk factors, it’s structured around three core dimensions:

- Financial Risk: Assessed using metrics such as Total Liabilities/Tangible Net Worth (TNW), Funded Debt/EBIT, and Debt/Equity.

- Qualitative Risk: Evaluated through scores for Business, Management, and Industry factors.

- Coverage & Liquidity Risk: Measured using ratios such as Debt Service Coverage Ratio (DSCR), EBIT/Interest, and Current Ratio.

Each dimension is assigned a grade based on predefined criteria, and the overall grade is determined by aggregating these results. The corresponding Probability of Default (PD) provides a quantitative measure of the organization’s default risk.

How The Model Components Are Allocated

Not to miss out a thing and determine the overall grade, the scoring system also includes in the calculation a range of individual grades for Financial Risk, Qualitative Risk, and Coverage & Liquidity Risk.

The grades are analyzed and combined using a weighted aggregation approach. This methodology ensures that the overall rating reflects the relative importance of each dimension while maintaining consistency with industry best practices.

Check the table below to get a better understanding:

What Do AAA to D Credit Ratings Mean?

According to the given Scoring System, the company’s overall performance ranges from AAA to D, comprising 10 grades, which provides one of the most inclusive approaches.

On the table below, each grade is provided with a decent description:

The Grading Model As a Powerful Tool For Risk Scoring

When evaluating borrowing projects, it’s crucial for experts to maintain objectivity and apply a comprehensive approach that considers all key factors influencing financial stability and risk. A multipurpose assessment ensures that no critical aspect is overlooked, adding to a more accurate and reliable scoring process.

The Maclear safety team has carefully selected this Scoring Model because it best aligns with investor expectations, providing them with the insights needed to make informed decisions and achieve long-term success. For borrowing projects, this rigorous risk evaluation serves as both a benchmark and a motivating factor, highlighting areas for financial improvement, encouraging better risk management, and the adoption of higher financial standards.

This is achieved by the key objectives of the Model, including:

- Risk assessment: To evaluate the organization’s financial stability, operational efficiency, and exposure to various risks.

- Decision support: To inform strategic decisions, such as resource allocation, investment planning, and risk mitigation.

- Stakeholder communication: To provide stakeholders with a clear and concise summary of the organization’s risk profile and performance.

- Monitoring and improvement: To track changes in risk levels over time and identify areas for improvement.

With the introduction of this enhanced borrower scoring system, Maclear continues to provide a transparent, structured, and data-driven approach to the platform security. Your trust is always our top priority.

Stay tuned for further updates!